Many times when people describe stocks of large companies like Amazon, Apple and Microsoft, they tell me “it’s too expensive”. I’m not immune from it - I sold some Amazon stock I owned in 2013 at $226 because I thought the same and even wrote about it. At the time, AWS was a $1.5B business (which I ended up working for) and is now close to $50B.

Fast-growing companies are ‘expensive’ for good reason. They compound revenue pretty darn quickly.

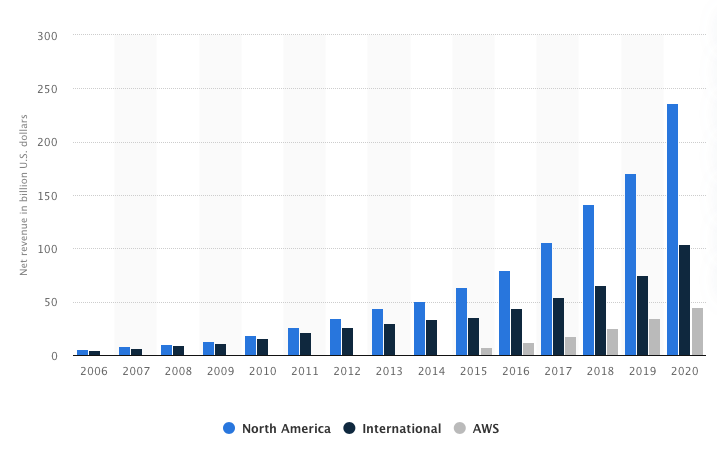

Today, Amazon announced 2021 Q1 earnings with growth of 44% year-over-year (YoY). In the last 12 months, Amazon’s revenue has surpassed $400B. They have three highly-successful segments that continue to grow exponentially.

AWS: 32% YoY

North American Retail: 50% YoY

International Retail: 60% YoY

But Safeer - it’s too expensive.

Cloud computing (AWS) and e-commerce (retail) are still in the early innings. Both segments have captured less than 20% of their respective market (IT infrastructure and general retail). These business segments will continue to thrive in the next coming decades.

On average, Amazon has been growing 30-45% year-over-year (YoY) in revenue for several years. If they continue growing at ~35% YoY, their revenue will 3x in four years.

Do the math: 1.35^4 years = 3.32.

At similar valuations and sustained growth, Amazon stock will triple in four years.

6 yr ago: $430

3 yr ago: $1400 (4x)

Today: $3500 (2.5x)

In 4 yrs: $10K (3x)

“Our favorite holding period is forever” - Warren Buffett

I buy every week.