“The correct lesson to learn from surprises is that the world is surprising.”

― Morgan Housel, The Psychology of Money

Happy New Year and thanks for subscribing to my Substack!

To ring in the new year, I have updated my 2022 stock portfolio. Note: if you already use my M1 portfolio it will not auto-update and you will need to follow manual steps listed at the end. Before that, a few thoughts on 2022.

2021 has been an interesting year. I encourage you to re-read my post reflecting on 2020 and predictions for 2021. In it, I predicted:

Change isn’t linear

Consistency hedges against timing

Middle class America and non-coastal cities

Rise of digital entrepreneurship

Rise of personal finance

Rise of asset prices (housing, stock market)

Roaring twenties

Nationalism vs globalization

Bitcoin

US is strong as ever

All of these predictions came true and will continue to be critical themes in 2022.

Covid, remote work, labor shortages, housing shortages, inflation, interest rate hikes, supply chain crisis and affordability issues will present extremely volatile times the next few years. Challenges always bring opportunities and I am optimistic that the United States and American companies are well positioned to invest and tackle these issues.

At the same time, asset prices will be volatile as the Fed plans three interest rate hikes next year in an attempt to control inflation. Assets that people bought to speculate instead of something they find value in purchasing or investing will price correct even further than other assets (and already have started to the last few months). As we’ve talked about before, we are playing a different game - anticipating the tides and ready to ride through the waves.

My 2022 portfolio

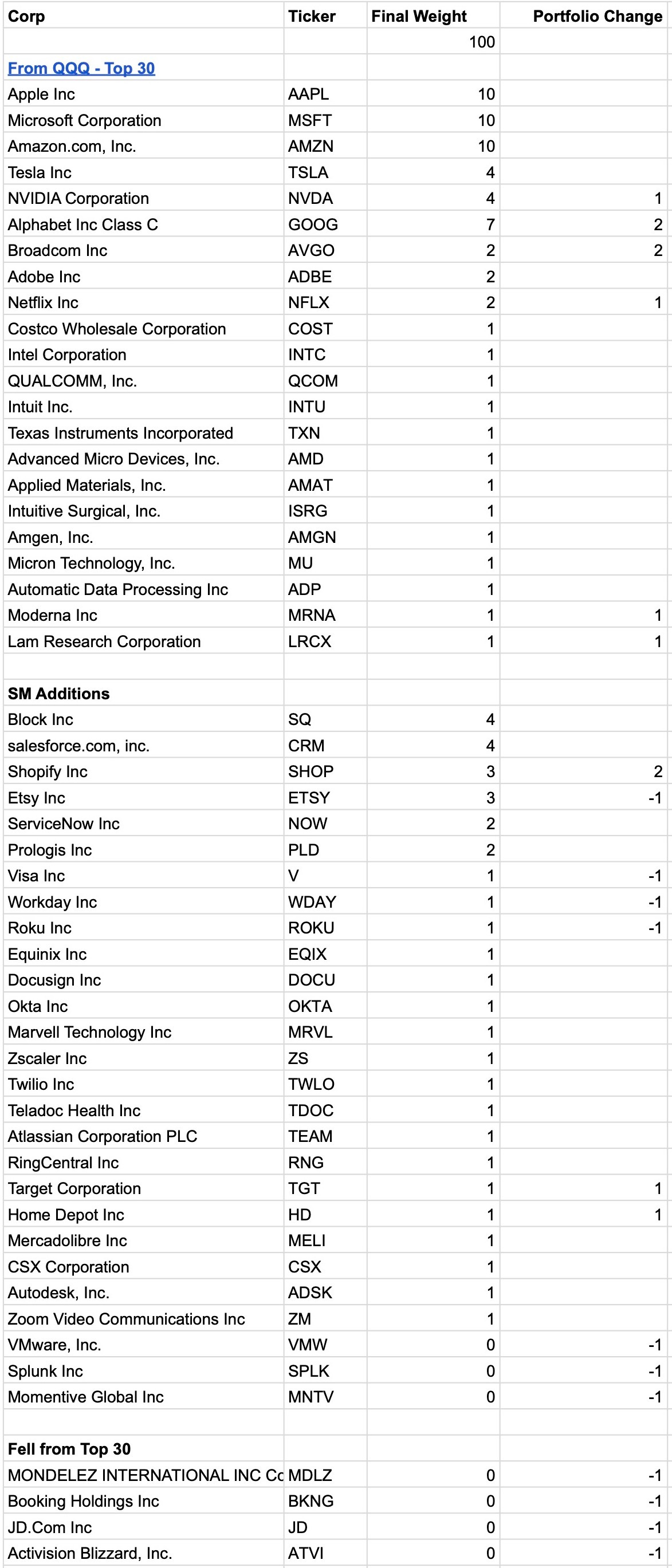

Active investors statistically perform worse than passive investors. No one can time the market. That’s why majority of my portfolio follows the QQQ index, which contains the Top 100 of Nasdaq stocks including top tech companies (FAANG, etc). Because it’s a weighted index, well-performing stocks become a larger percent of the pie and those that decline fall out.

My basket of stocks contains:

The top 65% of QQQ with a few filtered out (too much debt, etc)

A few handpicked stocks across the technology sector that make up the remaining 35%.

My secret is simple: I buy every week. Consistency hedges against timing the market.

I also recommend you check out my personal finance guide: 101.finance.

If you already use my portfolio, below are some steps to update it:

Go to the link, make sure you’re logged in and click ‘Save to my account’

Then go to your M1 app, click ‘Manage pie’ -> ‘Edit pie’ -> ‘+’ Button

Go to the ‘My Pies’ tab, select ‘Safeer’s 2022 Portfolio’ and ‘Done’

Adjust the 2022 Portfolio to 100% and remove the old portfolio

M1 will automatically calculate which stocks to purchase/sell based on the new percentages.

Happy New Year,

Safeer